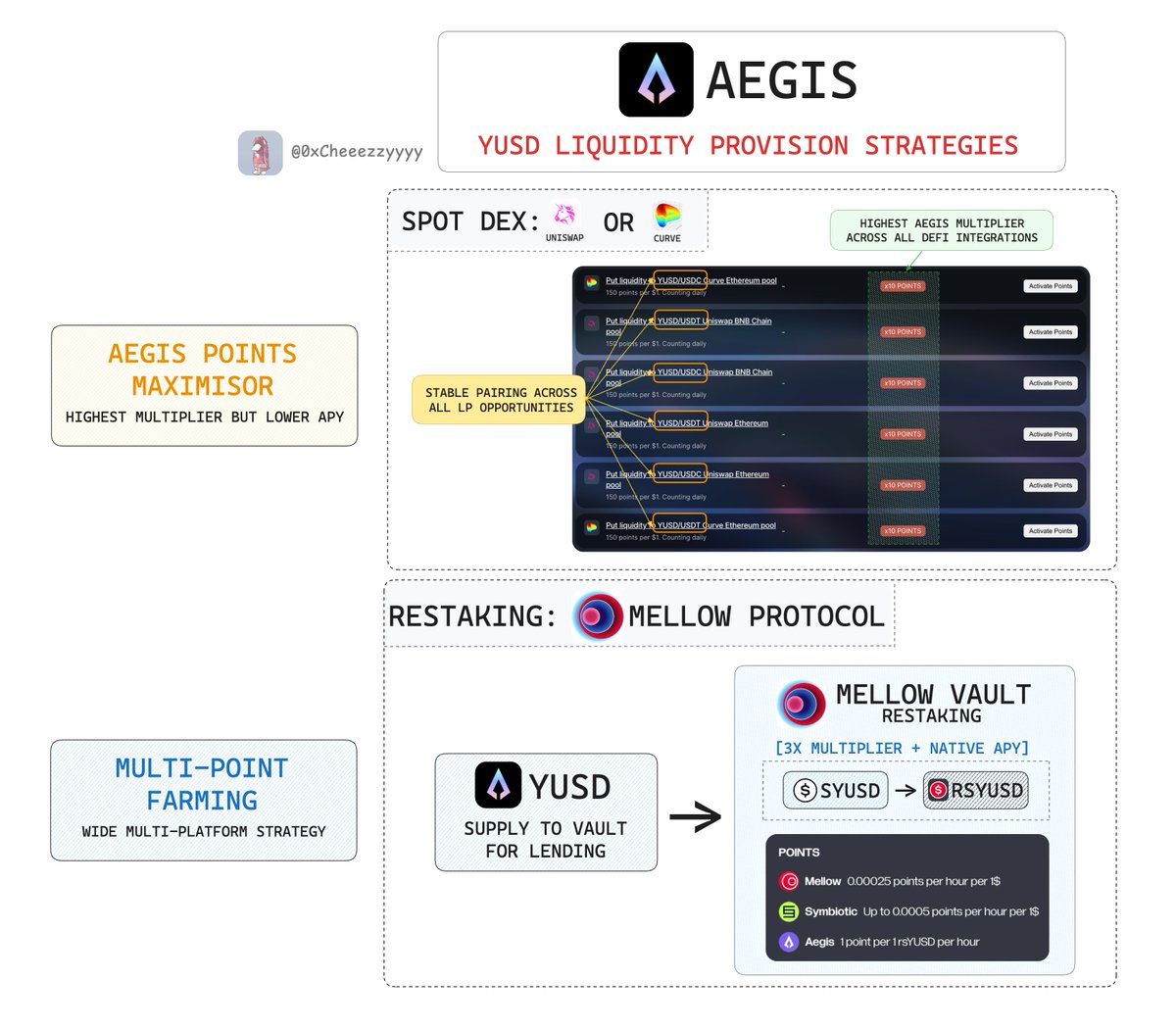

There are plenty of ways to put @aegis_im $YUSD to productive work, but LP strategies deserve more attention imo:

1⃣ Spot DEX LP via @Uniswap / @CurveFinance

🔸Highest Aegis points multiplier (10x boost → the most across all DeFi opportunities)

🔸Minimal IL since it’s paired in stable pools

*Trade-off: Yields depend heavily on trading volume, so APY is relatively lower.

If your goal is maximising Aegis points, LP-ing is the most straightforward path.

2⃣ Restaking via @mellowprotocol

Deposit $sYUSD → $rsYUSD through vaults to unlock:

🔹Native APY (~2.37%)

🔹3x Aegis multiplier

🔹Multi-points exposure: Mellow (Mellow) + Symbiotic (@symbioticfi).

This strategy is ideal for those seeking layered yields + stacked points, while keeping optionality open for $rsYUSD’s future composability.

Both strategies carry relatively low risk of IL (given stablepair + single-sided vault LP), but differ in payoff.

TLDR:

LP-ing = max points, lower APY

Restaking = diversified yield stack, slightly lower multiplier.

which ever you pick has its own strengths.

6.37K

53

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.