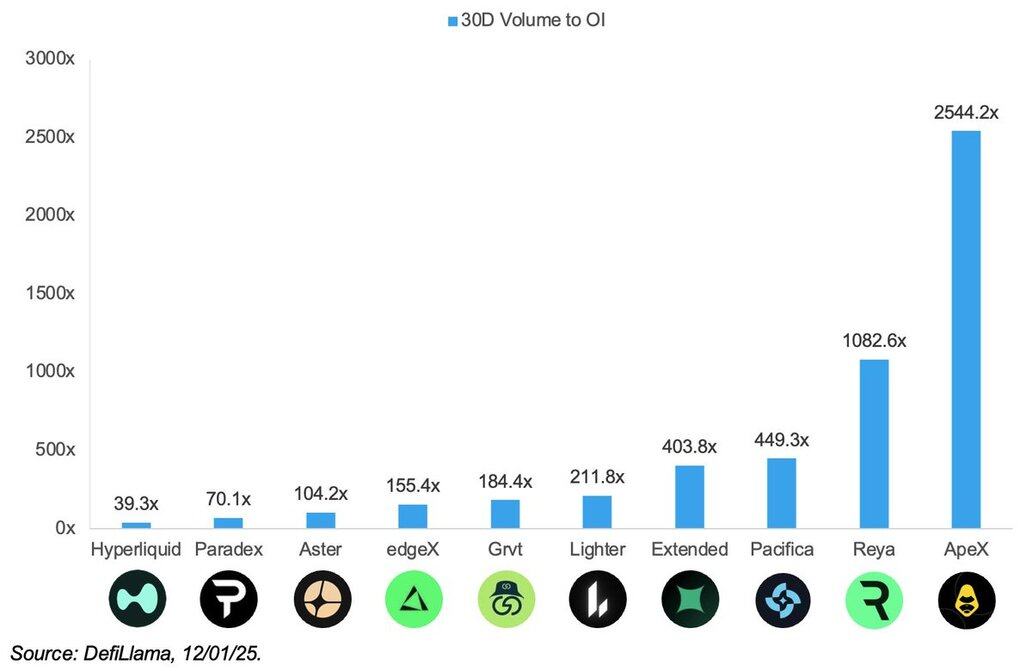

I do not expect volume/oi to scale linearly with volume, but as market volumes remain muted going into the holiday season, I will be keen to see which platforms maintain their current ratio. This will tell us which platform traders are willing to leave positions on while spending time with family.

In 12-18m when 90% of perp DEXs are gone these volume to OI ratios won't matter.

However, I think they can be somewhat helpful today in telling us which platform users trust.

High ratio = likely wash trading

Low ratio = likely more real volume/users

Yeah, oi can still be faked and farmed, but many of these perp dexs have overweighted points/xp to oi but oi still remains quite small even with the increase in incentives

Why? Because oi is capital at risk.

Volume farming is cheap. You wash trade, pay some fees, cycle the same $100k through the system 1000 times.

With oi farming you actually have to leave money at risk.

Even if you're hedging both sides, you're still 1) posting real collateral, 2) exposed to liquidation if you fat finger, 3) paying funding rates, and 4) taking counterparty risk on the exchange

Both volume and oi can be farmed but a lower volume to oi ratio likely means users trust that platform more.

As it stands today:

1) @HyperliquidX

2) @paradex

3) @Aster_DEX

4) @Lighter_xyz

5) @edgeX_exchange

6) @extendedapp

7) @pacifica_fi

8) @grvt_io

9) @OfficialApeXdex

I would be curious to get these founders to chime in.

But again, I don't think this will matter in 12-18m when 90% of perp dexs are gone.

^ again

i do not think this ratio will matter in 12-18m when 90% of perp DEXs are gone

this is just something fun to watch in the interim

1,184

6

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。