$HYPE and $SUI have similar market capitalizations, and their MC/FDV ratios are also comparable:

•SUI: Market cap of about $12 billion,

FDV of about $33.7 billion → MC/FDV ≈ 0.36

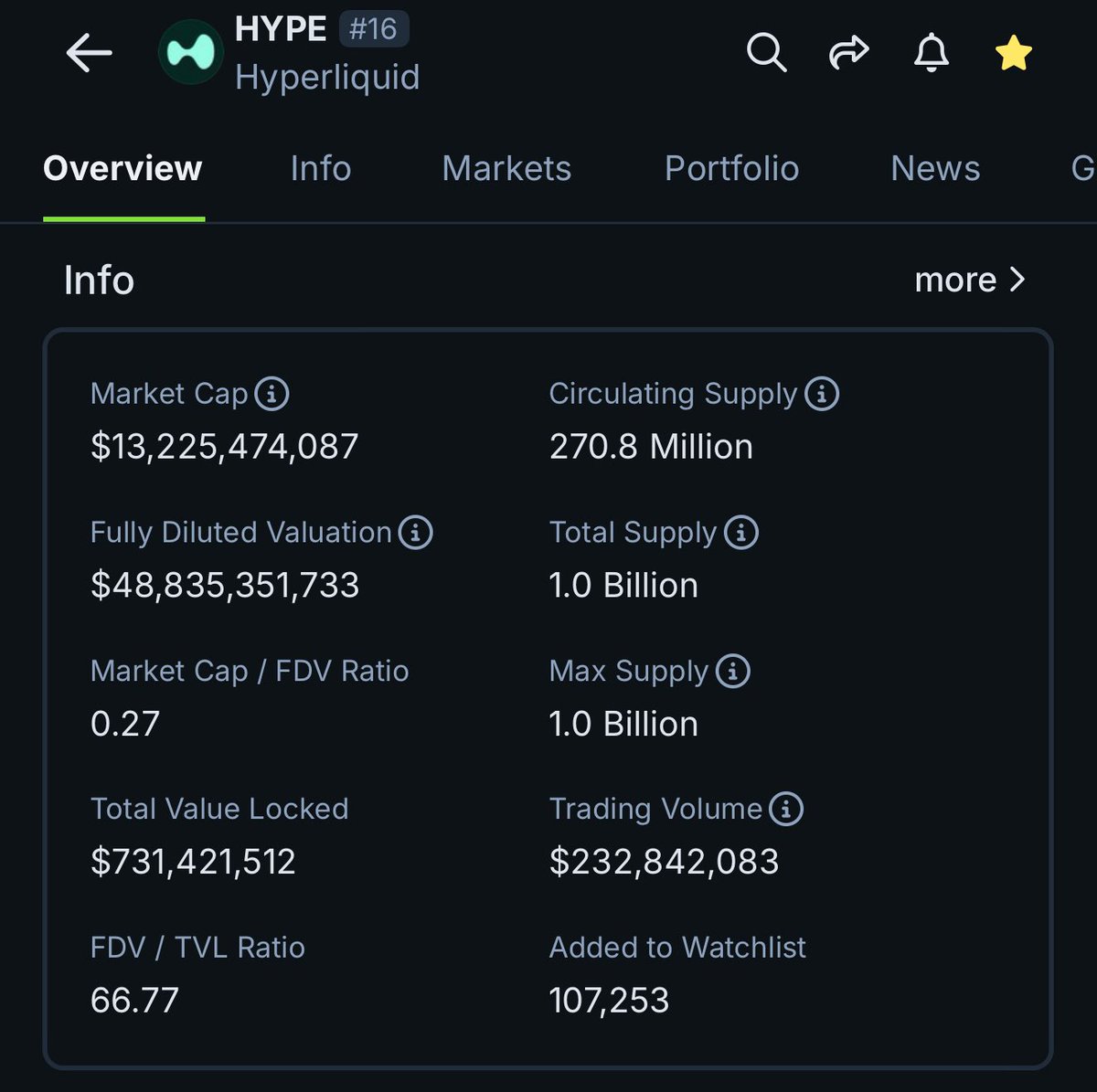

•HYPE: Market cap of about $12.7 billion,

FDV of about $48.6 billion → MC/FDV ≈ 0.27–0.33

However, the revenue in August shows a surprising gap:

•SUI: Only about $900,000

•Hyperliquid: Surpassed $106 million, with a trading volume of nearly $400 billion

With the same valuation, HYPE's revenue is 1,177 times higher, showcasing the cash flow advantage of DeFi perpetual trading. This also highlights the reality of similar market caps but drastically different business models.

SUI may need to create its own Hyperliquid to generate revenue; otherwise, the monthly DeFi subsidies will just be a disguised way of mining and selling, slowly leading into the next death spiral.

*Note* I hold HYPE & SUI 🙏🏼

Show original

31.5K

155

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.