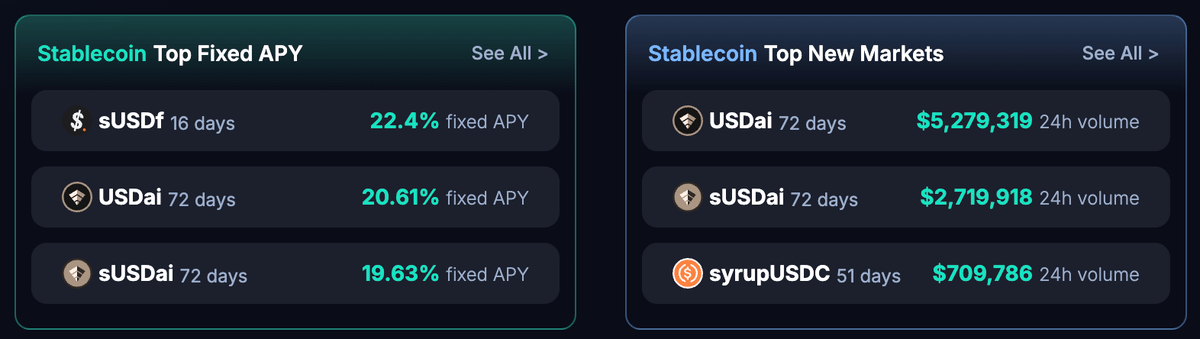

The AI boom is colliding with DeFi, and @USDai_Official is right in the middle of it. is building hardware-backed financing for AI infra, with a stablecoin (USDai) and its yield bearing counterpart (sUSDai) that scales alongside global compute demand. Every loan is 1:1 collateralized by GPUs and data centers, bringing real-world yield directly onchain. Early traction: - Already at $160M TVL since public launch in August. - Launched on @arbitrum and announced expansion to @PlasmaFDN - Their @pendle_fi pools have been trending since the last 2 weeks. Honestly, haven't seen such demand for a stablecoin before. Saw that caps opened last Thursday to $160M and was filled in 15 minutes. Because of that buy pressure: - USDai trades at a premium - Highest yielding PT asset on @pendle_fi with ~20% APY - Looping via @eulerfinance with USDC creates a 50%+ APY stablecoin position This is what a new financial primitive looks like: - Faster loan closure (under 7 days vs 60–90 in TradFi) - Yield...

Show original

9.44K

36

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.